The global AI insurance market is expected to grow from $4.59 billion in 2022 to $79.86 billion in 2032, an almost unbelievable 33.06% CAGR for an industry that is already big. Ever more companies are using AI to generate leads, with the global market leaders making hundreds of billions of dollars annually.

The competition in AI insurance lead gen is growing, but you still can get ahead with the right set of AI tools and techniques.

Read on to learn more about how artificial intelligence, insurance lead generation AI, and automated lead scoring can help you generate and convert more leads.

Enhancing Insurance Lead Generation With AI Tools

There are only two customer acquisition strategies out there: You can either buy insurance leads or generate them with earned and paid media, each method with its pros and cons.

While buying insurance leads can bring quicker results, generating insurance leads might be more productive and sustainable in the long run.

You can generate insurance leads via:

- Email campaigns

- Cold calling

- Content marketing

- Social media advertising

- Search engine optimization (SEO)

All these methods can bear quite tangible results, but even more so if you’ve synergized them with specific insurance lead generation AI tools that automate and optimize the process.

Here are some of the superpowers of advanced AI algorithms, all increasing the likelihood of conversion:

- Personalizing marketing strategies

- Predicting customer behavior

- Facilitating real-time client interactions

- Providing personalized recommendations

- Analyzing lead data

- Resolving queries promptly

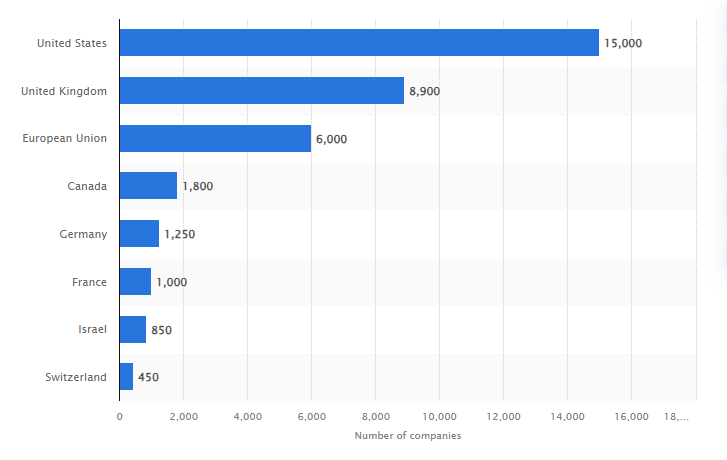

Nowadays, AI tools are widely used — you may notice the growth of artificial intelligence (AI) companies in the world’s major economies in 2023:

Source: Statista

Benefits of Insurance Lead Generation AI Tools

Even for the brightest of minds, your own creative ideas may not always be enough. Sometimes, the best you can do is take advice from generative AI like ChatGPT, rely on chatbots to handle customer queries, or leverage AI social media tools to generate leads.

Source: Medium

Today’s social networks manage to engage clients successfully — at least, the Facebook Messenger bot is quite popular.

Check out how to generate leads insurance via social media:

Here’s why conversational AI is an exceptional lead generation tool for insurance companies:

- Customer education: Chatbots can instantly provide basic information about insurance policies and clarification.

- Intelligent engagement: Conversational artificial intelligence has a range of prompts that engage clients through interactive conversations.

- Accessibility: Insurance lead generation AI is available on various platforms, which builds trust in the insurance sector.

- Resilience to crisis situations: During the COVID-19 pandemic, personal interaction has been limited, and the demand for artificial intelligence has increased.

Lead Scoring: Efficient Insurance Lead Generation Using AI Tools

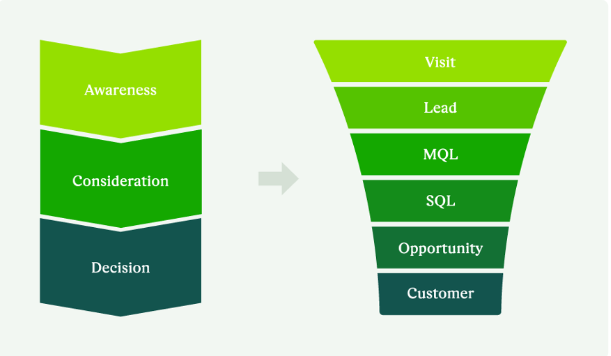

Both sales and marketing departments evaluate and rank visitors based on their likelihood of becoming paying customers, focusing resources on the leads that are most likely to convert. By assigning points to leads based on their behavior, demographics, and engagement, lead scoring helps connect the right leads with the right agents or sales representatives.

Lead scoring works perfectly when it comes to lead generation for insurance agents:

- Lead scoring helps distinguish between marketing-qualified leads (MQLs) and sales-qualified leads (SQLs). MQLs can be identified based on their engagement with marketing materials, while SQLs can be recognized by a stronger purchase intent.

- Having clear lead scoring guidelines helps companies ensure that only the most promising leads, which match specific criteria, are sent to the sales team for further interaction. This approach effectively stops the squandering of valuable resources.

Source: Upwork

Lead scoring can help you generate high-quality insurance leads by:

- Detecting leads that show the highest conversion potential using a numerical score

- Helping to personalize insurance leads support strategies

- Automating and speeding up the customer evaluation process

- Monitoring potential clients in real-time

- Ensuring an effective segmentation of potential clients

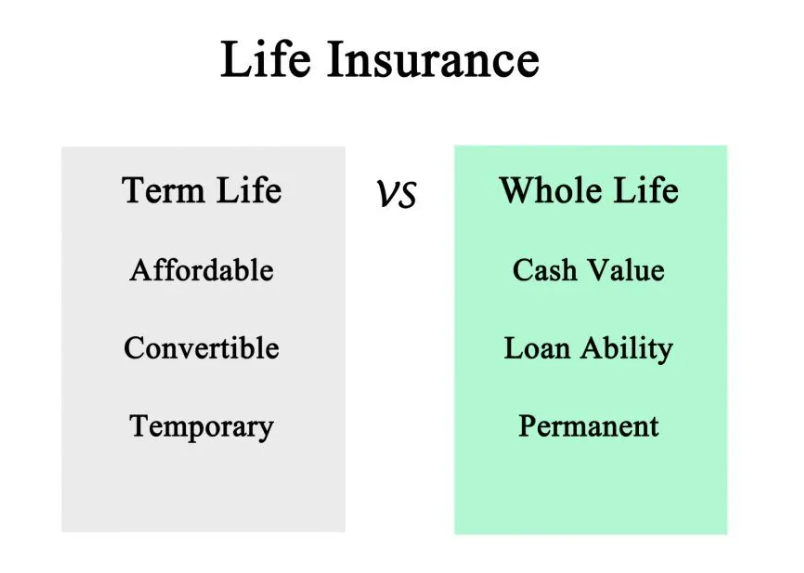

For example, you can score life insurance leads by the following factors:

- Age

- Gender

- Health condition

- Occupation and lifestyle

- Policy type (whole life insurance vs term life insurance)

- Coverage limit

Source: How To Buy Life Insurance Leads

Machine Learning and Lead Scoring

The impact of machine learning on predictive lead scoring in insurance is enormous. For example, if you own a life insurance company and want to facilitate lead generation for insurance, here’s how you can do it:

| Renovated data analysis | A predictive AI-powered lead scoring system can analyze more information than people, including demographics, online behavior, and past interactions, to identify patterns and trends. |

| Personalized customer engagement | Insurance lead generation AI systems highlight client preferences and behavior — you will be able to adapt your communication strategies and propose individual recommendations. |

| Elevated sales process | The system tells about the eagerness of each potential customer to buy. This knowledge allows your sales team to engage with prospects at the right time and with the right content. |

| Upbeat allocation of resources | By using insurance lead generation AI systems, you can reduce costs and raise the overall return on investment for your insurance business. |

| Progressed retention | Providing a more customer-centric experience is advantageous, often resulting in increased loyalty and fostering long-term relationships. |

After assigning points to a potential client, you can properly prioritize your time and efforts. Forget about hesitating clients — concentrate on increasing sales performance and ROI. Lead scoring enables companies to work smarter, not harder, to pursue sustainable growth.

Buy and Sell Insurance and Solar Leads with Profitise

The Profitise affiliate network might become your best place to monetize insurance and solar leads or – if you’re an advertiser – purchase high-intent leads for your business.

Here’s what Profitise offers:

- Selling or buying insurance and solar leads at the best price

- Connecting to the biggest pool of insurance and solar advertisers and affiliates

- Customizable lead generation forms

- Around-the-clock support from an affiliate manager

Sign up as an affiliate or advertiser to start selling or buying leads with Profitise. For questions, contact us at info@profitise.com or call 888-400-4868.

Frequently Asked Questions

What are insurance leads?

Insurance leads are people who show interest in acquiring an insurance policy that covers property, travel, vehicles, health, and anything else that can be insured.

How to generate leads for insurance sales?

Here’s how to generate leads in insurance:

- Know your target buyer: demographics, psychographics, etc.

- Harness omnichannel marketing: social media, content marketing, SEO, etc.

- Provide relevant content — blogs, videos, and webinars.

- Invest in AI-driven tools for managing high-quality leads.

- Tap into affiliate, referral, and influencer networks.

What is insurance lead generation AI?

Insurance lead gen AI is the type of artificial intelligence that helps marketers generate and convert more insurance leads via lead scoring and multiple other automated algorithms.

When it comes to lead scoring, insurance lead generation AI assigns scores based on data patterns, customer interactions, and behaviors, allowing businesses to focus on promising prospects.

What are the benefits of insurance lead generation AI?

Here are the advantages of insurance lead generation using AI for businesses and agents:

- Enhanced customer education

- Intelligent engagement

- Accessibility and transparency

- Resilience to crises

- Improved lead scoring

What is conversational AI?

Conversational AI is a set of technologies that simulate human-like conversations with users. This advanced solution, often integrated into chatbots and virtual assistants, allows for natural language processing, understanding, and response generation.